Introduction to Finance Guide

Finance is a critical aspect of any business, it plays a vital role in helping organizations to achieve their goals and grow. Whether you’re a small startup or a well-established enterprise, understanding the basics of finance is crucial for staying competitive in today’s economy.

In this post, we will delve deeper into the different pillars of finance, including financial management, investment, and financial analysis, and how they can be used to achieve your business goals.

From budgeting and forecasting to risk management and financial reporting, each pillar plays an important role in creating a comprehensive financial strategy.

By staying up-to-date with the latest trends and best practices, businesses can make informed financial decisions that drive growth and success.

What is Money?

Money is a frequently used form of exchange that is used to pay for products and services. It serves as a standard for deferred payment, a store of value, and a unit of account. Money can take many forms, including physical currency, coins, and digital currency.

Physical money, like coins and bills, is tangible and can be exchanged directly for goods and services. Digital money, like electronic transfers and digital currency, is intangible and is used to facilitate transactions through electronic means.

Money also serves as a standard unit of account, which means it is used to measure the value of goods, services, and assets. It also serves as a store of value, allowing individuals and businesses to save and invest for the future. Finally, money is a standard of deferred payment, meaning it can be used to pay for goods and services at a later date.

In modern economies, money is typically issued by a central authority, such as a central bank or government, and can take the form of physical currency, like paper money and coins, or digital currency, like electronic transfers and digital money.

In short, money is a medium of exchange that facilitates transactions and serves as a unit of account, a store of value, and a standard of deferred payment.

How does Money Help One’s Life

Money plays a critical role in our daily lives, as it is essential for purchasing goods and services, saving and investing for the future, and achieving financial stability and security.

- Purchasing Goods and Services: Money allows individuals to buy the things they need and want, such as food, clothing, housing, and entertainment. Without money, it would be difficult to obtain the basic necessities of life.

- Saving and Investing: Money also allows individuals to save and invest for the future. This can include setting aside money for emergencies, planning for retirement, and investing in assets such as stocks, bonds, and real estate. By having savings and investments, one can secure their financial future and plan for the long term.

- Achieving Financial Stability and Security: Money also helps individuals achieve financial stability and security by allowing them to pay their bills and expenses, manage debt, and plan for unexpected events such as medical emergencies or job loss.

- Economic Mobility: Money also plays an important role in economic mobility, it allows people to move up the economic ladder, by providing access to education, training, and job opportunities.

- Enables Participation in the Economy: Money enables people to participate in the economy by allowing them to purchase goods and services, invest in businesses, and create jobs.

In summary, money plays a critical role in our daily lives by allowing us to purchase goods and services, save and invest for the future, achieve financial stability and security, and also enable economic mobility and participation in the economy.

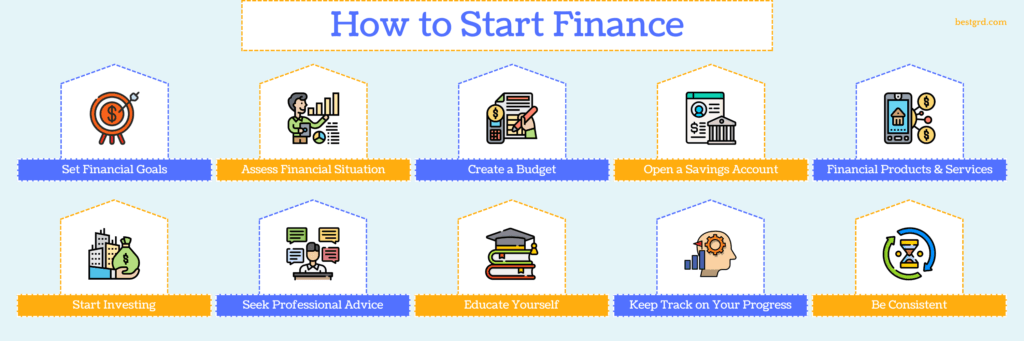

How to Start with Finance?

Starting with finance can seem overwhelming, but it doesn’t have to be. Here are some steps you can take to get started:

- Set your Financial Goals: Determine what you want to achieve financially, whether it’s paying off debt, saving for retirement, or buying a house.

- Assess your Current Financial Situation: Take a look at your current income, expenses, assets, and liabilities.

- Create a Budget: Use your financial goals and current situation to create a budget that will help you reach your financial goals.

- Open a Savings Account: Open a savings account and start setting aside money each month to help you reach your financial goals.

- Learn about Financial Products and Services: Research different financial products and services, such as savings accounts, investment options, and insurance policies, to determine which ones are right for you.

- Start Investing: Start investing your money in low-cost, diversified investment options such as index funds or ETFs.

- Seek Professional Advice: Consider seeking the advice of a financial advisor or professional, particularly if you’re dealing with complex financial decisions or have a significant amount of money to invest.

- Educate Yourself: Read books, articles, and other resources about personal finance, investing, and money management to help you make informed decisions.

- Keep Track of your Progress: Keep track of your progress by monitoring your budget, savings and investment accounts, and credit score.

- Be Consistent: Stick to your financial plan and make adjustments as necessary. Remember that starting with finance is a process, and it takes time and consistency to see results.

Why Finance is so Important?

Finance is important for several reasons. Firstly, it allows individuals to manage their personal finances and plan for their future by budgeting, saving, and investing. This can help ensure financial stability and security, both now and in the future.

Secondly, finance is essential for businesses and the economy as a whole. It allows companies to raise capital, make investments, and manage risk. This helps them to grow and expand, which in turn creates jobs and drives economic growth.

Thirdly, finance plays a critical role in allocating resources efficiently. Financial markets, such as stock and bond markets, allow investors to channel their money into companies and projects that have the potential to yield high returns. This helps to ensure that resources are directed towards the most productive uses, promoting economic growth and development.

Fourthly, finance is also important for public policy. Governments rely on finance to fund public goods and services, such as infrastructure and education. They also use fiscal and monetary policy tools to stabilize the economy and promote growth.

Lastly, finance plays an important role in global economic activity. Financial markets and institutions facilitate the flow of capital across borders, supporting international trade and investment.

In summary, finance is essential for personal and financial stability, economic growth, and efficient resource allocation, thus it plays a crucial role in our daily lives and the functioning of businesses and the economy as a whole.

Management of Finance

The management of finance involves the effective planning, organizing, directing, and controlling of financial resources in order to achieve an organization’s financial goals and objectives. It involves several key activities, including:

- Budgeting and Forecasting: Creating financial plans and forecasts to guide the allocation of resources and manage cash flow.

- Financial Analysis: Evaluating the financial performance of the organization using tools such as ratio analysis and trend analysis.

- Financial Planning and Strategy: Developing long-term financial plans and strategies to achieve financial goals and objectives.

- Investment Management: Identifying, evaluating, and managing investments to maximize returns and minimize risk.

- Risk Management: Identifying and managing financial risks, such as credit risk and market risk.

- Financial Control and Reporting: Establishing financial controls and reporting mechanisms to ensure compliance with financial regulations and laws, and to provide accurate and timely financial information to stakeholders.

- Treasury Management: Managing the organization’s cash, credit, and debt to ensure adequate liquidity and optimize the use of financial resources.

- Fundraising: Identifying and accessing sources of funding, such as loans, grants, and equity financing.

- Mergers and Acquisitions: Assessing and managing the financial aspects of mergers and acquisitions.

- Financial Innovation: Identifying and implementing new financial products, services, and technologies to improve the organization’s financial performance.

Effective management of finance requires a combination of technical knowledge, analytical skills, and strategic thinking. The management of finance is a key function in any organization, regardless of its size or sector, and it plays a crucial role in ensuring the financial health and sustainability of the organization.

Advantages (Pros) and Disadvantages (Cons) of Finance

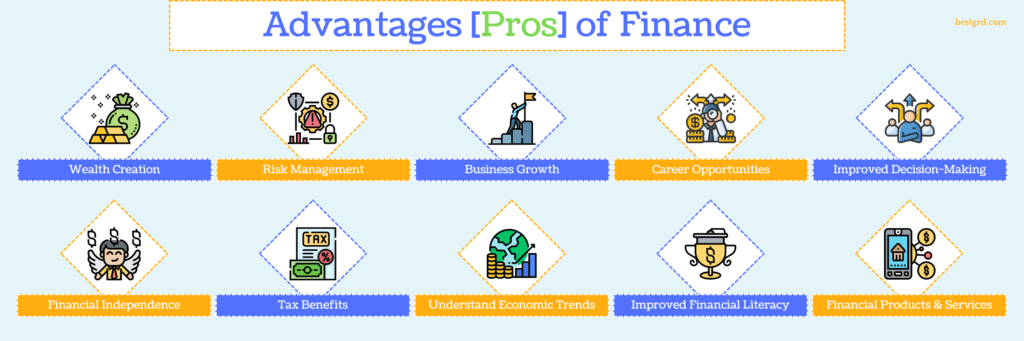

Advantages (Pros) of Finance

- Wealth Creation: Finance allows individuals and businesses to increase their wealth by making smart investments and managing their finances effectively.

- Risk Management: Finance provides tools and techniques for managing and mitigating risks associated with investments and other financial activities.

- Business Growth: Finance is essential for businesses to grow and expand by obtaining funding, managing cash flow, and making strategic investments.

- Career Opportunities: There is a high demand for finance professionals in various industries, providing many career opportunities.

- Improved Decision-Making: Having a strong understanding of finance can help individuals and businesses make better decisions by providing an understanding of financial options and consequences.

- Financial Independence: Effective management of personal finances can lead to financial independence and security.

- Tax Benefits: Knowledge of finance can help individuals and businesses take advantage of tax benefits and deductions.

- Better Understanding of Economic Trends: Understanding finance can help individuals and businesses understand economic trends and make more informed decisions.

- Improved Financial Literacy: A strong understanding of finance can help improve overall financial literacy and knowledge.

- Innovation in Financial Products and Services: Advancements in finance can lead to innovation in financial products and services that can benefit individuals and businesses.

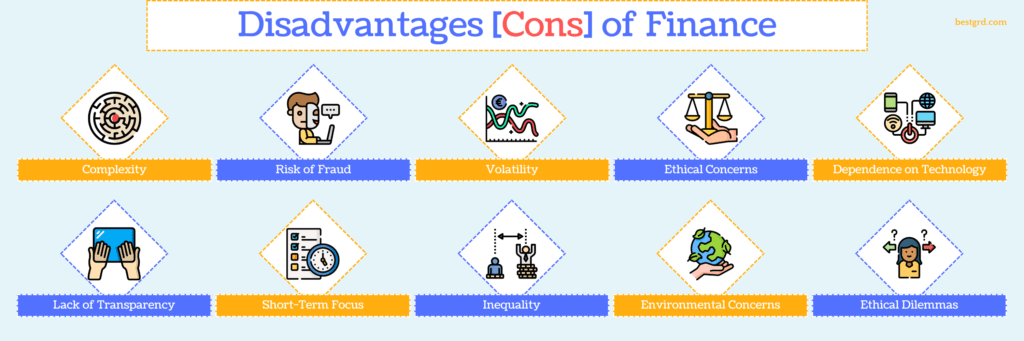

Disadvantages (Cons) of Finance

- Complexity: The field of finance can be complex and difficult to understand for many people.

- Risk of Fraud: Finance is vulnerable to fraud and scams, which can cause financial losses for individuals and businesses.

- Volatility: The value of investments can be highly volatile and subject to rapid fluctuations, which can cause financial losses.

- Ethical Concerns: The finance industry has been criticized for unethical practices, such as insider trading and financial fraud.

- Dependence on Technology: Many financial transactions are now conducted online, which can make them vulnerable to hacking and other forms of cybercrime.

- Lack of Transparency: Some financial institutions and products can be opaque and difficult for consumers to understand.

- Short-Term Focus: Some financial institutions and investors have a short-term focus, which can lead to neglect of long-term sustainability.

- Inequality: The finance industry has been criticized for exacerbating income inequality by providing more opportunities and resources to the wealthy.

- Environmental Concerns: Some financial activities, such as certain types of investments, can have a negative impact on the environment.

- Ethical Dilemmas: Finance professionals may face ethical dilemmas when balancing the interests of their clients with the public good.

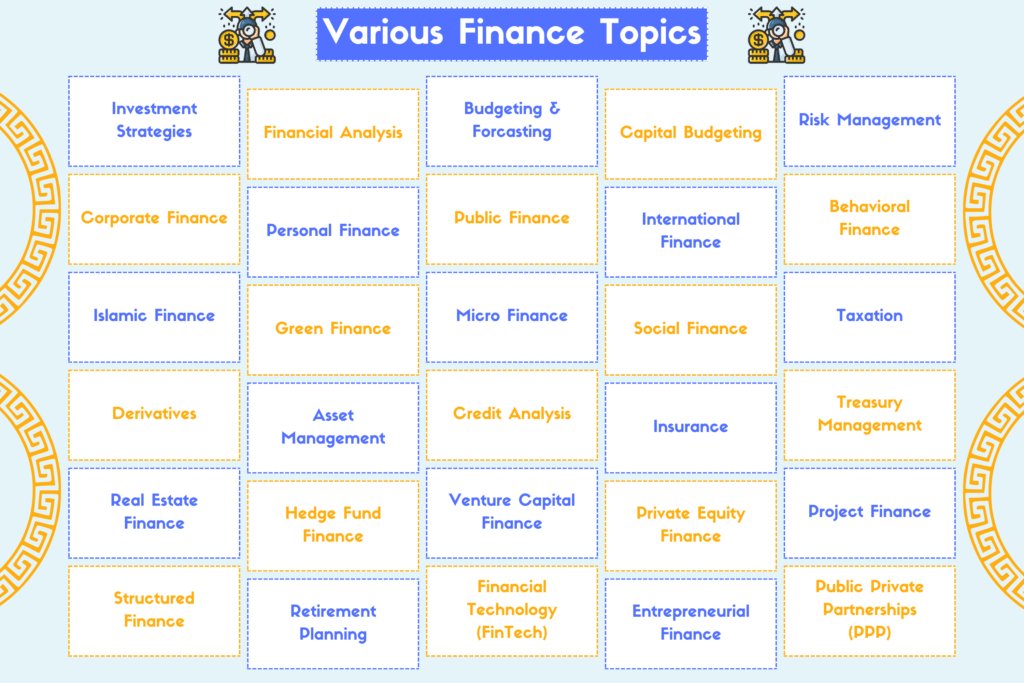

Various Finance Topics to be Understood

Here are a few topics that are commonly covered in the field of finance:

- Investment Strategies: How to evaluate stocks, bonds, and other investment opportunities in order to maximize returns and minimize risks.

- Financial Analysis: Techniques for evaluating a company’s financial performance, such as ratio analysis and trend analysis.

- Budgeting and Forecasting: How to create financial plans and forecasts to guide the allocation of resources and manage cash flow.

- Capital Budgeting: How to evaluate and select long-term investment opportunities, such as new products, expansion projects, and acquisitions.

- Risk Management: How to identify and manage financial risks, such as credit risk and market risk.

- Corporate Finance: The management of the financial resources of a corporation, including the raising of capital, investment decisions, and financial planning.

- Personal Finance: The management of an individual’s financial resources, including budgeting, saving, investing, and planning for retirement.

- Public Finance: The management of the financial resources of a government, including taxation, spending, and borrowing.

- International Finance: The management of financial resources and financial risks in a global context, including foreign exchange, trade finance, and cross-border investments.

- Behavioral Finance: The study of the psychological factors that influence financial decision-making, including emotions, biases, and heuristics.

- Islamic Finance: The management of financial resources according to Islamic principles, including a prohibition on charging or paying interest (riba).

- Green Finance: The management of financial resources in a way that supports environmentally sustainable development, including investment in renewable energy and energy efficiency.

- Microfinance: The provision of small loans and other financial services to individuals and small businesses in developing countries.

- Social Finance: The management of financial resources in a way that supports social and environmental objectives, including impact investing and community development finance.

- Taxation: Understanding of the tax laws and regulations that apply to your financial situation, including personal income tax, corporate tax, and investment income tax.

- Derivatives: The use of financial instruments such as options and futures to manage risks and generate returns.

- Asset Management: The management of portfolios of assets, such as stocks, bonds, and real estate, for the purpose of generating returns for investors.

- Credit Analysis: The evaluation of credit risk and the ability of a borrower to repay a loan.

- Insurance: The management of risk by transferring it to an insurer in exchange for a premium.

- Treasury Management: The management of a company’s cash, debt, and investment portfolio.

- Real Estate Finance: The management of financial resources related to real estate properties, including the acquisition, development, and management of properties.

- Hedge Fund Finance: The management of investment funds that use a variety of strategies to generate returns for investors, including hedging against market risks.

- Venture Capital Finance: The management of funds invested in start-up and early-stage companies in order to provide capital, expertise, and guidance to help these companies grow and succeed.

- Private Equity Finance: The management of funds invested in private companies, with the goal of generating returns through ownership of a portion of the company or through a sale or IPO.

- Project Finance: The management of financial resources for specific projects, such as infrastructure development or natural resource extraction, with the goal of ensuring that the project is financially viable and sustainable.

- Structured Finance: The management of complex financial products, such as securitization, that are designed to transfer and manage financial risks.

- Retirement Planning: The management of financial resources to provide for financial needs after retirement.

- Financial Technology (FinTech): The use of technology to improve and automate financial services, including online lending and digital payments.

- Entrepreneurial Finance: The management of financial resources for start-up and early-stage companies, including seed funding, angel investing, and venture capital.

- Public-Private Partnerships (PPP): The management of financial resources for public infrastructure projects through partnerships between the public and private sectors.

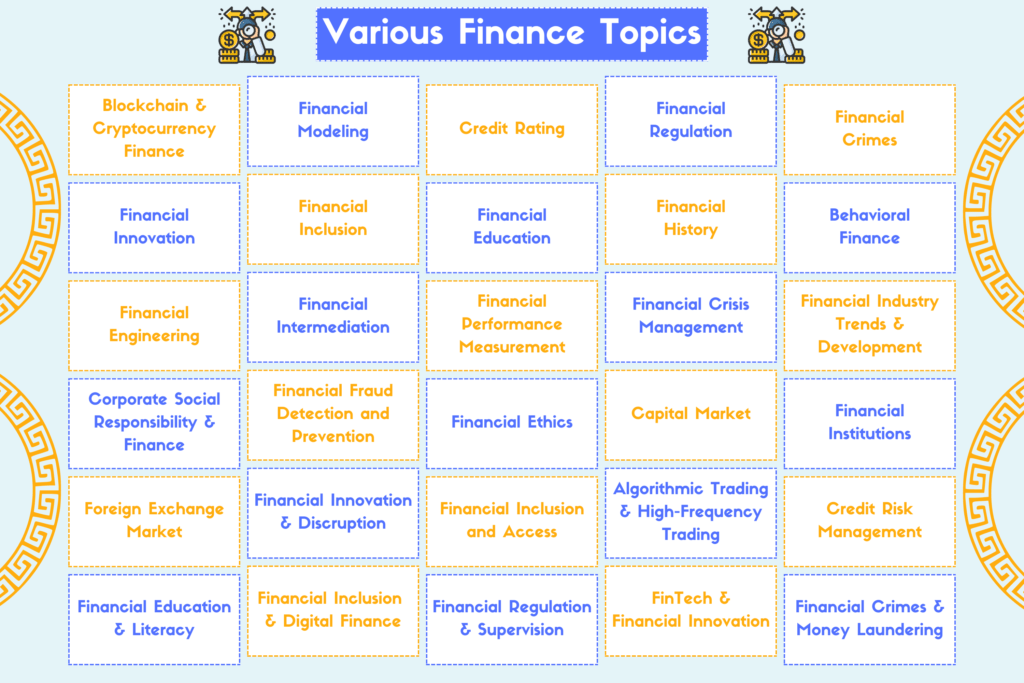

- Blockchain and Cryptocurrency Finance: The management of financial resources using blockchain technology and digital currencies, such as Bitcoin and Ethereum.

- Financial Modeling: The use of mathematical and statistical techniques to build financial models that can be used to forecast financial performance and evaluate investment opportunities.

- Credit Rating: The evaluation of the creditworthiness of a borrower or issuer of debt securities.

- Financial Regulation: The laws and regulations that govern the financial industry, including the role of financial regulators and the oversight of financial institutions.

- Financial Crimes: The detection and prevention of financial crimes, such as money laundering and fraud.

- Financial Innovation: The development of new financial products and services, such as mobile payments and Robo-advisers.

- Financial Inclusion: The provision of financial services to underbanked or unbanked populations, such as microfinance and mobile banking.

- Financial Education: The education and training of individuals and organizations on financial management and investment strategies.

- Financial History: The study of the historical development of financial systems and institutions, and their impact on economic and social developments.

- Behavioral Finance: The study of the psychological factors that influence financial decision-making, including emotions, biases, and heuristics.

- Financial Engineering: The application of mathematical and engineering methods to the design and analysis of financial products and markets.

- Financial Intermediation: The role of financial intermediaries, such as banks and mutual funds, in channeling funds from savers to borrowers.

- Financial Performance Measurement: The use of financial metrics, such as return on equity, to evaluate a company’s financial performance.

- Financial Crisis Management: The management of financial crises, such as banking crises and sovereign debt crises.

- Financial Industry Trends and Developments: The identification and analysis of the trends and developments that are shaping the financial industry.

- Corporate Social Responsibility and Finance: The management of financial resources in a way that aligns with the values of the company and stakeholders, including environmental and social impact.

- Financial Fraud Detection and Prevention: The identification and prevention of financial fraud, such as insider trading, Ponzi schemes, and money laundering.

- Financial Ethics: The study of ethical principles and guidelines that govern the financial industry, including issues such as insider trading, and conflicts of interest.

- Capital Market: The market for long-term investments, such as stocks and bonds, and how they are traded, valued, and regulated.

- Financial Institutions: The role and functions of different financial institutions, such as banks, insurance companies, and investment firms, and how they operate in the financial system.

- Foreign Exchange Market: The market for buying and selling different currencies, including how exchange rates are determined and how they are affected by economic and political events.

- Financial Innovation and Disruption: The impact of new technologies, such as blockchain and AI, on the financial industry and how they are changing the way financial services are provided.

- Financial Inclusion and Access: The provision of financial services to disadvantaged and under-served populations, such as low-income individuals and small businesses.

- Algorithmic Trading and High-Frequency Trading: The use of computer algorithms and high-speed trading systems to buy and sell securities in financial markets.

- Credit Risk Management: The management of the risk of default by borrowers, including the use of credit scoring, collateral, and credit insurance.

- Financial Education and Literacy: The importance of financial education and literacy in promoting financial well-being, and the role of government and private sector in providing financial education programs.

- Financial Inclusion and Digital Finance: The use of digital technologies, such as mobile banking and digital payments, to provide financial services to underserved populations.

- Financial Regulation and Supervision: The role of government regulators in ensuring the stability and integrity of the financial system, and the oversight of financial institutions.

- FinTech and Financial Innovation: The impact of new technologies, such as blockchain and AI, on the financial industry and the ways they are changing the way financial services are provided.

- Financial Crimes and Money Laundering: The detection and prevention of financial crimes such as money laundering, terrorist financing, and fraud, and the role of financial institutions in detecting and preventing such crimes.

Conclusion of Finance Guide

In conclusion, finance is a vital aspect of any business, it encompasses everything from personal savings and investment decisions to corporate financial planning and management.

Each pillar of finance, such as financial management, investment, and financial analysis plays an important role in creating a comprehensive financial strategy. By understanding the basics of finance, businesses can make informed financial decisions that drive growth and success.

However, it’s important to remember that financial management is not a one-time task, it’s an ongoing process that requires consistent efforts and adaptation to the changes in the market and the economy.

By staying up-to-date with the latest trends, and best practices and seeking professional help if needed, businesses can ensure their financial stability and growth.

Frequently Asked Questions of Finance Guide

1. What is finance?

Finance is the study of how individuals, organizations, and governments manage money to achieve their goals. It involves the management of assets and liabilities, and the creation and management of financial products and services.

2. What are the main areas of finance?

The main areas of finance include personal finance, corporate finance, and public finance. Personal finance deals with the management of an individual’s money, corporate finance deals with the management of a company’s money, and public finance deals with the management of a government’s money.

3. What are the types of financial instruments?

The types of financial instruments include stocks, bonds, options, futures, and derivatives. Stocks represent ownership in a company, bonds represent debt, options, and futures are derivatives of stocks and bonds, and derivatives are financial products that derive their value from an underlying asset.

4. What is the difference between saving and investing?

Saving is the act of putting money away for a future purpose, such as retirement or a down payment on a house. Investing is the act of using money to acquire assets that have the potential to generate income or appreciate in value.

5. What is the time value of money?

The time value of money is the concept that money today is worth more than the same amount of money in the future due to the potential for that money to earn interest or appreciation in value.

6. What is financial risk?

Financial risk is the possibility of losing money due to an uncertain event or market condition. This can include risks such as interest rate risk, currency risk, and credit risk.

7. What is a financial plan?

A financial plan is a roadmap for achieving financial goals. It includes an assessment of an individual’s or organization’s current financial situation, a set of financial goals, and a plan for achieving those goals through saving, investing, and managing debt.

8. What is a budget?

A budget is a plan for managing an individual’s or organization’s money, detailing projected income and expenses. It helps to keep track of spending, plan for future expenses, and achieve financial goals.

9. What is credit?

Credit is the ability to borrow money, typically in the form of loans, credit cards, or lines of credit. It allows individuals and businesses to acquire assets or finance expenses that they may not be able to pay for upfront.

10. What is a credit score?

A person’s credit score provides a numerical representation of their creditworthiness. It is based on an individual’s credit history and is used by lenders to determine the risk of lending money to that individual. A good credit score can make it easier to obtain loans and credit at favorable terms.

11. What is a stock?

A stock usually referred to as a share or equity denotes ownership in a corporation that is publicly traded. When an individual or organization purchases a stock, they become a shareholder of that company and have a claim on a portion of its assets and profits.

12. What is a bond?

A bond is a debt instrument in which an investor loans money to an entity, such as a corporation or government, in exchange for regular interest payments and the return of the principal at maturity. Bonds are considered to be less risky than stocks but offer lower returns.

13. What is a mutual fund?

An investment instrument known as a mutual fund collects funds from a number of people to buy a diverse portfolio of stocks, bonds, or other securities. Mutual funds are managed by professional fund managers and offer a convenient way for individuals to gain exposure to a diversified portfolio of assets.

14. What is an ETF?

An ETF, or exchange-traded fund, is a type of investment vehicle that tracks a particular index, sector, or basket of assets. ETFs are similar to mutual funds but are traded on stock exchanges and can be bought and sold throughout the trading day.

15. What is a financial advisor?

A financial advisor, also known as a financial planner, is a professional who provides advice and guidance on financial matters such as saving, investing, and retirement planning. They can help individuals and organizations to create financial plans, manage their investments, and make informed financial decisions.

16. What is a financial statement?

A financial statement is a report that provides information on an individual’s or organization’s financial performance and position. The balance sheet, income statement, and cash flow statement are common financial statements.

17. What is a cash flow statement?

A cash flow statement is a financial statement that shows the inflow and outflow of cash in an individual’s or organization’s operations. It helps to track the sources and uses of cash and can be used to predict future cash needs.

18. What is a credit report?

A credit report is a detailed summary of an individual’s credit history, including information on credit accounts, payment history, credit inquiries, and any outstanding debts. It is used by lenders to determine an individual’s creditworthiness and is also used to track any errors or fraudulent activity.

19. What is a financial market?

A financial market is a platform where financial instruments such as stocks, bonds, currencies, and derivatives are bought and sold. Examples include stock markets, bond markets, currency markets, and commodity markets.

20. What is a financial regulator?

A financial regulator is an organization or government agency that oversees and enforces rules and regulations in the financial industry. Examples include the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, and the Reserve Bank of India (RBI) in India.

END NOTE

Congratulations on reaching the end of this informative and educational blog! We hope that you have learned some valuable tips and tricks to help you take control of your finances and achieve your financial goals. If you have any questions or would like more information, please don’t hesitate to ask. We’re here to help you succeed! Start with Finance: Empowering You to Take Control of Your Money with 4 Easy Ways

Are you feeling more confident about managing your finances now that you’ve read this blog? Let us know in the comments below!

Best Guide to Reach Your Destination [bestgrd.com]